Our Services

Venturezen, Inc. is a full-service strategic advisory firm specializing assisting our clients improve results and expand value to the business. We partner with companies and financial institutions providing services in i) Corporate Finance Advisory, ii) Debt Placement Services, iii) International Services and iv) Equity Finance Support.

Our partners come from a diverse financial background ranging from corporate and commercial banking, investment banking, asset management, corporate account and tax services and management consulting. We look to engage and work closely with our clients in order to tailor solutions and services necessary to help take the business to the next level. Whether seeking to improve operating inefficiencies, improve cash flow, raising new capital, we lean on our industry depth knowledge, experience, and operational expertise to stabilize the business and create lasting

results.

Corporate Finance Advisory:

-

Market understanding

-

Market research

-

Capital Management

-

Lending structure, placement and maintenance

-

Banking Management

-

Treasury Management

-

Trade services

-

Card services

-

Financial Modeling

-

Growth strategies

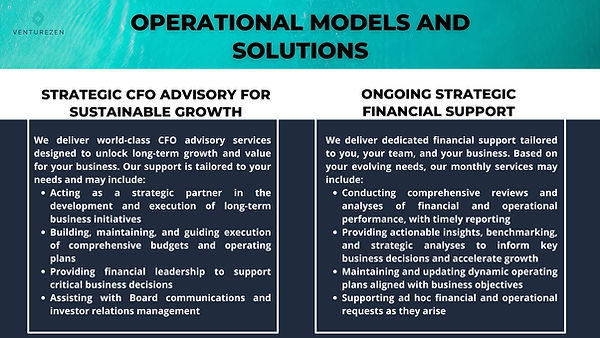

Strategic CFO Advisory Services & Solutions

Lending Services:

-

Asset-Based Lending: Availability is based on a percentage of accounts receivable, inventory, fixed assets and sometimes intellectual property.

-

Cash Flow Lending: Open structure with less reporting than an asset-based line, but often more financial covenants. May include advance rates on A/R, inventory, etc.

-

Loans or leases amortized over many years to purchase/refinance manufacturing equipment, rolling stock (trucks, vans, etc.), computers and racking just as some examples.

-

Term loans could also be used to provide long-term working capital.

International Services:

-

Import/export

-

Letters of credit and banker’s acceptances

-

Documents against payments

-

Foreign exchange strategies

-

US banking advisory services

-

Country manager/administrative services

-

Account opening

-

US account maintenance and compliance

-

Light treasury management maintenance.

Equity Finance Support:

-

Improving lending terms through Non-Executive implementation and banking relationship management support

-

Providing access to Business Angels, Private Equity and Venture Capital Funding sources

-

Setting company up for Enterprise Investment Scheme Relief and Seed Enterprise Investment Scheme Relief

-

Business planning including cash-flow modelling of business

Our Fees

We aim to be affordable and realise that cost and cash flow are important decision in appointing Venturezen. As a result, we will be flexible on our fee structure and happy to discuss day rates, equity participation, fixed assignment fees and profit participation.

For our fees, please schedule a free consultation meeting with an advisor.